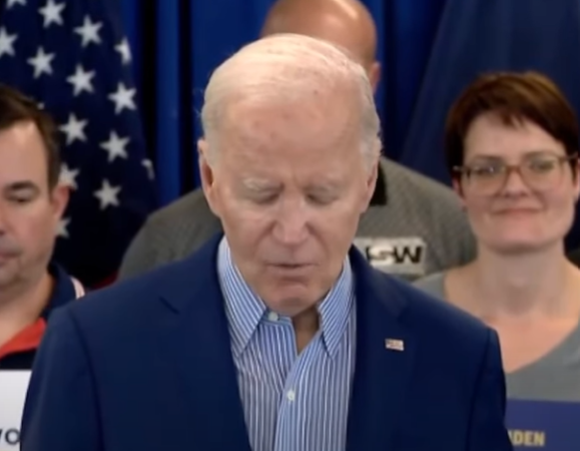

Old Uncle Joe is currently mulling over the possibility of releasing oil from the U.S. Strategic Petroleum Reserves (SPR) at a rate of over 1 million barrels per day for a period of over six months as the price of fuel continues to skyrocket all across the nation, as stated in a recent report.

“The plan under consideration would release around 1 million barrels per day from the Strategic Petroleum Reserve for the coming months, a person familiar with the deliberations says,” stated CNN in a release. “The release plan could last as long as six months, the person said, though the duration was still being finalized. That would amount to 180 million barrels of oil.”

This past November, Biden injected roughly 60 million barrels of oil from the SPR, an amount that marks it as the largest of its kind in history, he stated at the time, and then proceeded to release yet another 30 million barrels at the start of just this month.

However, a million barrels a day is just barely a bandaid on the massive problem. It was reported by the U.S. Energy Information that, “In 2020, the United States consumed an average of about 18.19 million barrels of petroleum per day, or a total of about 6.66 billion barrels of petroleum” over the course of the full year.

At that time, Biden claimed 32 million barrels “will be an exchange over the next several months, releasing oil that will eventually return to the Strategic Petroleum Reserve in the years ahead,” with well over 18 million authorized for sale from Congress. That means that the total sum of oil tapped will just equate to slightly over 2.5 days worth.

the tapping into this reserve will not solve the overarching production issue nor will it lower the prices for any significant period of time, either. “Analysts have warned an SPR release would only produce a short-term effect in the market, as it would not increase U.S. production capacity,” claimed Reuters.

Back in November, one website highlighted the fact that stocks were running out. “According to data from the Energy Information Administration last week, U.S. crude oil inventories fell 2.1 million barrels and stand 7% below the five year average for this time of year, while domestic crude oil production also saw a slight drop to 11.4 million barrels per day,” read a report from GasBuddy.

“Gasoline inventories fell by a slight 700,000 barrels and stand 4% below the five year average range, while distillate inventories also declined by 800,000 barrels and stand 5% below the five year average range. Implied gasoline demand, a proxy for retail gasoline demand, fell 18,000bpd to 9.24 million barrels per day. Refinery utilization continued to rally, posting a rise of 1.2 percentage points to 87.9% nationally,” added the website.

Leave a Reply